Duggal Visual Solutions is a global supplier of printed visuals, custom displays, and multimedia solutions for a wide-ranging clientele of image-conscious brands. Since becoming the first company to implement aACE 4 in the spring of 2010, they’ve seen exponential growth — and so has aACE.

At aACE Software, we’re proud to say that our product has been developed through years of working hand-in-hand with our customers, evolving feature sets in line with their real-world workflows. Nowhere is this more evident than in our decade-long relationship with Duggal, an aACE Enterprise customer that has helped us enhance our offerings over the years while easily customizing their own aACE solution to fit their one-of-a-kind workflows.

Challenges & aACE Solutions

Robust Support That Grows with Your Company

When the team at Duggal began looking for an ERP solution back in 2009, they were a much smaller company of about 100 employees. Over the past ten years they’ve grown to over 4 times that number — and aACE has been with them every step of the way. “It’s been a steady climb up,” says Matthew Pelfrey, Duggal’s Director of Process and Compliance. “We’ve bought other companies and brought in entire divisions. And without very much onboarding attention, we put [those new employees] in front of computers and they work with aACE. It’s intuitive.”

“I would say that new users pretty much get it within a week,” adds Rick Jacobs, Director of IT. “I think they find it to be very easy to learn and to use.”

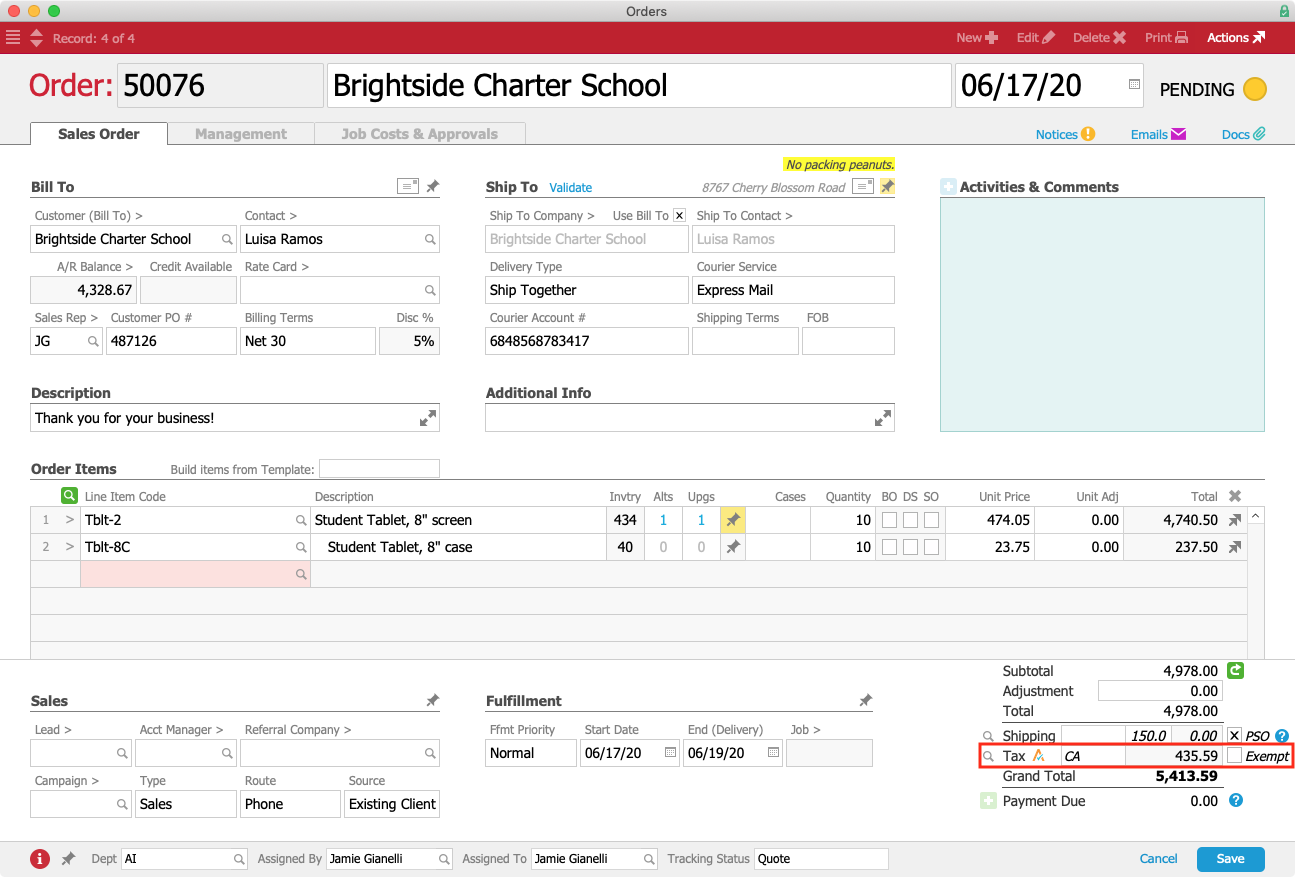

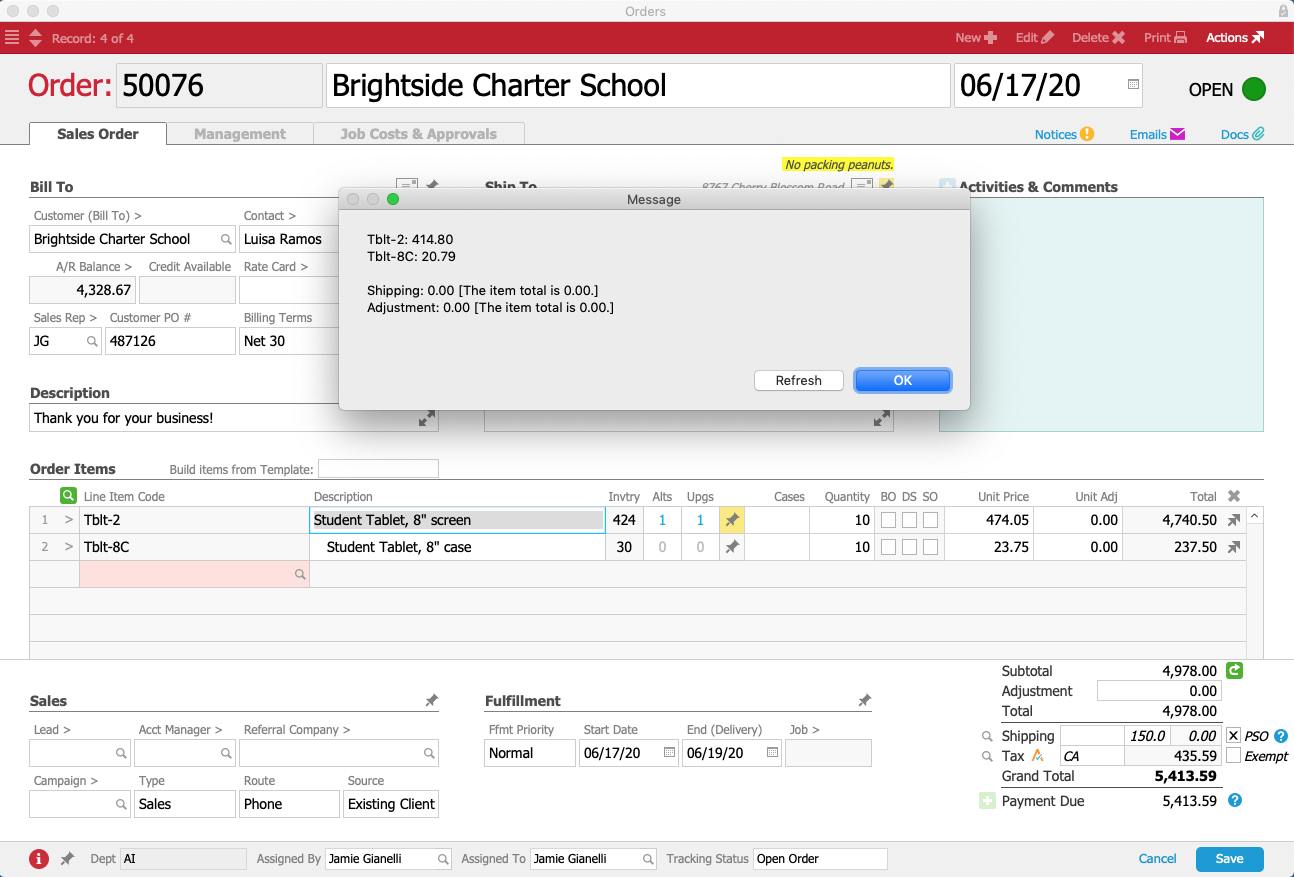

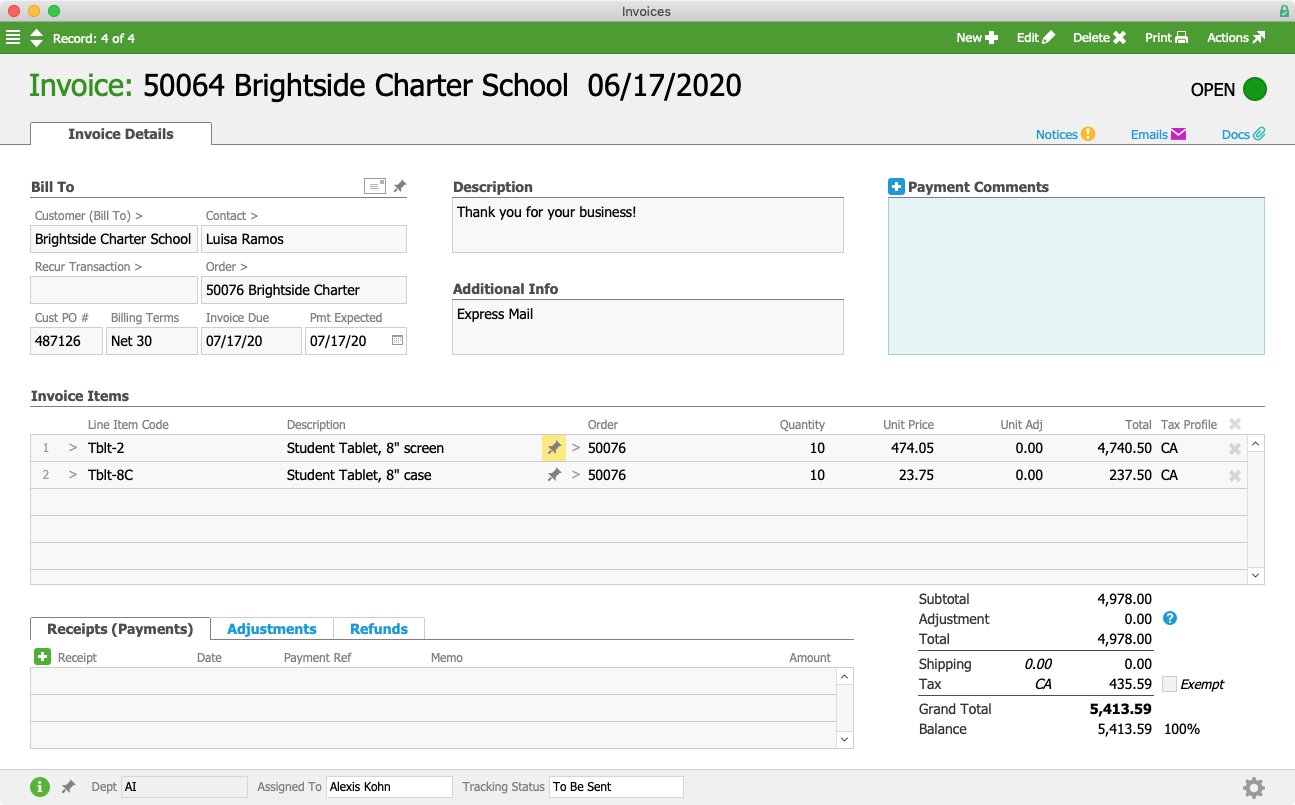

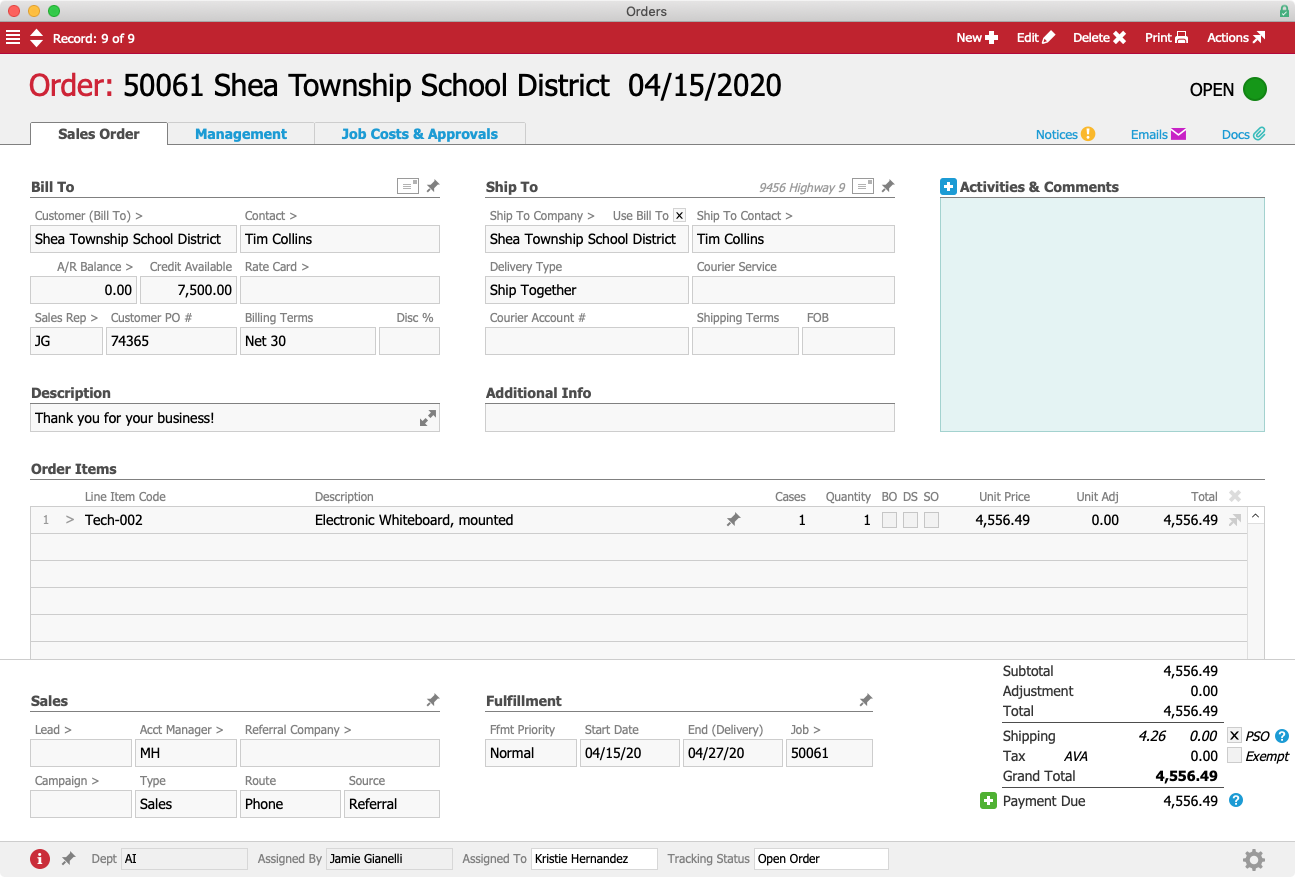

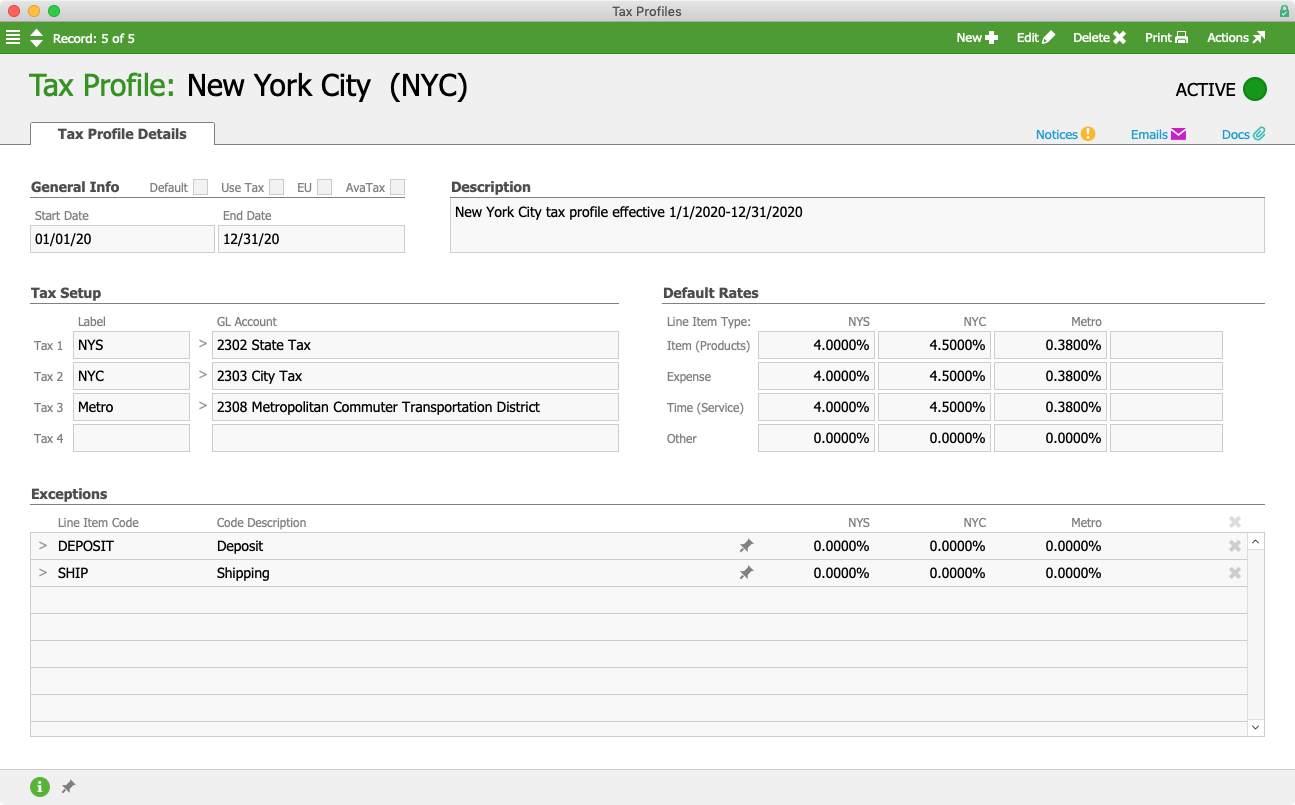

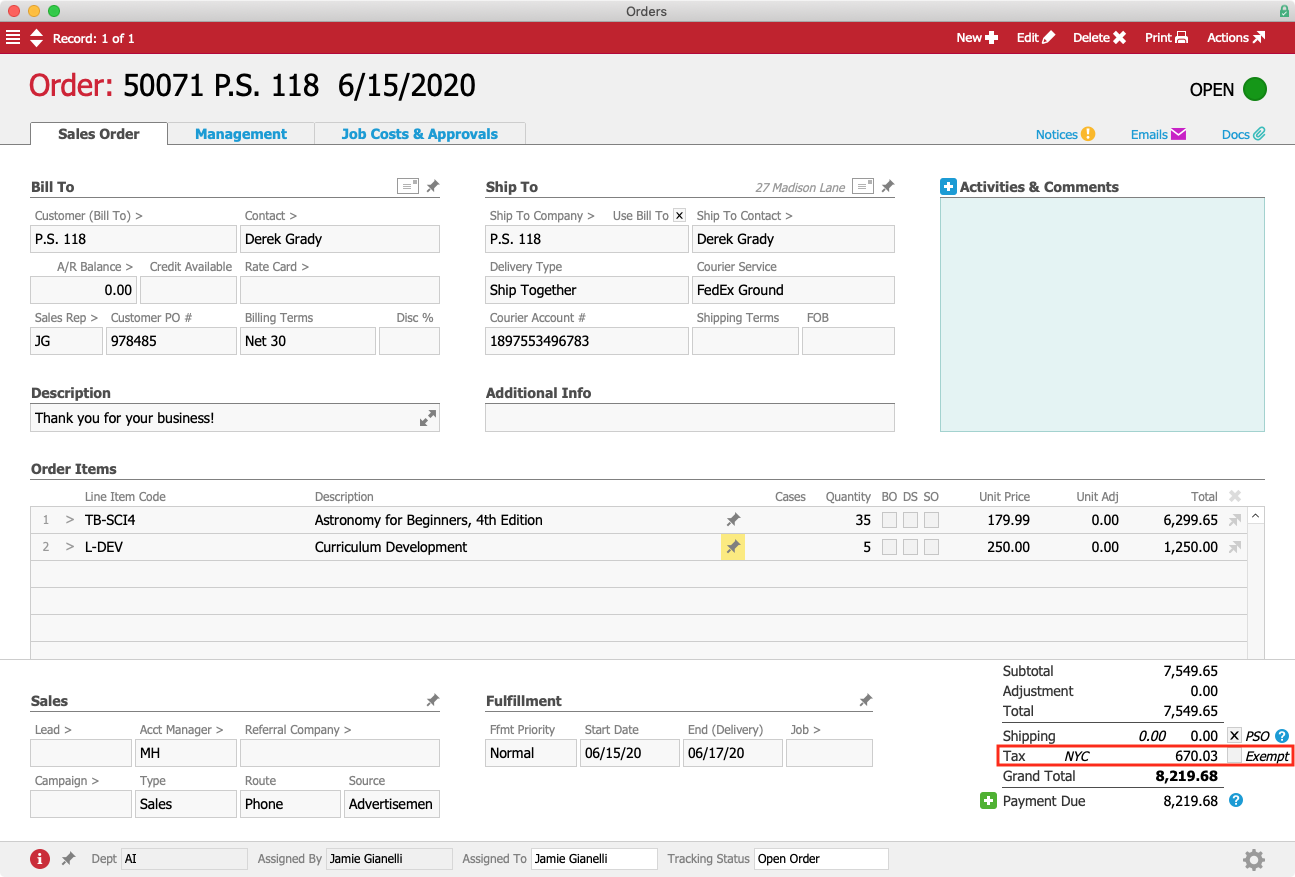

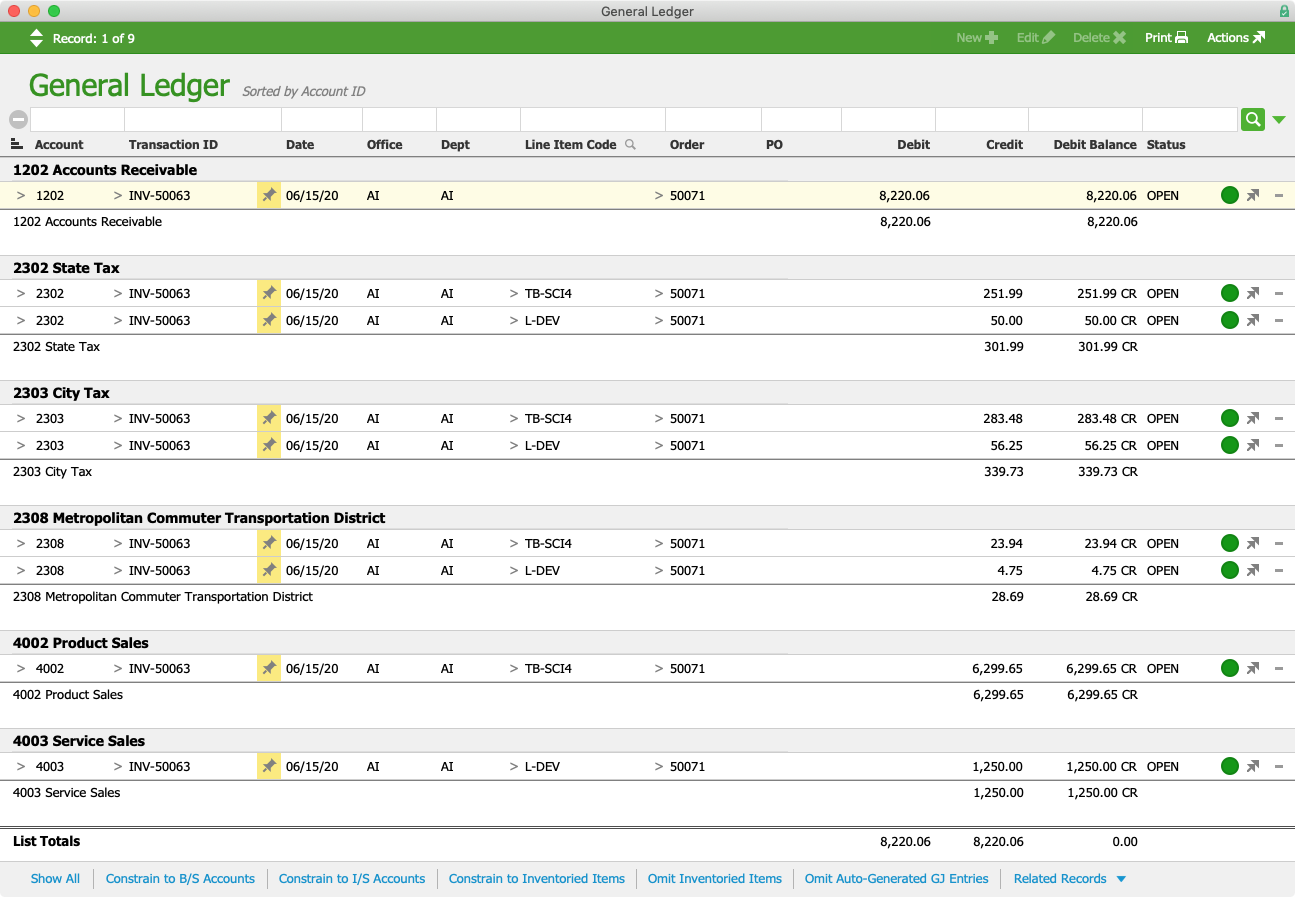

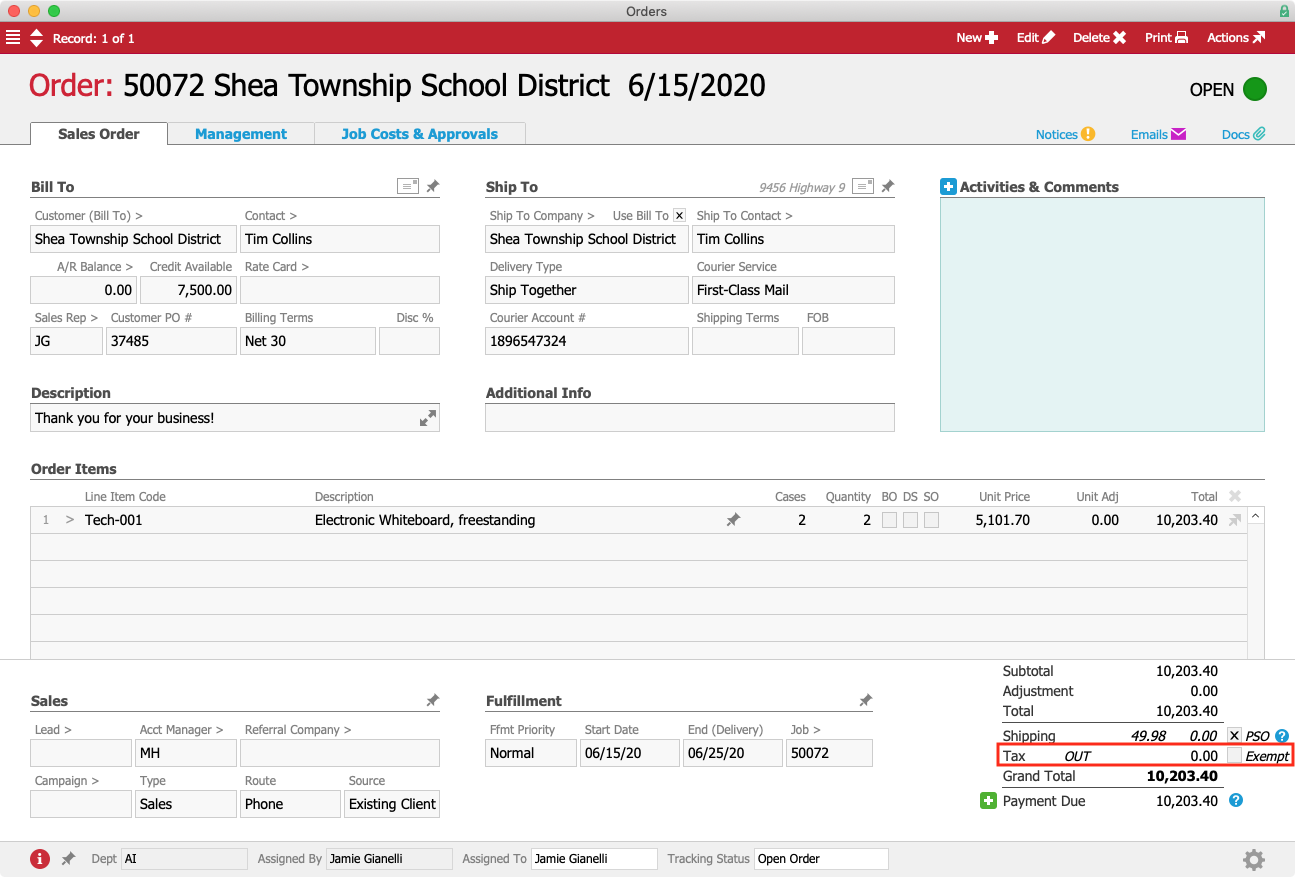

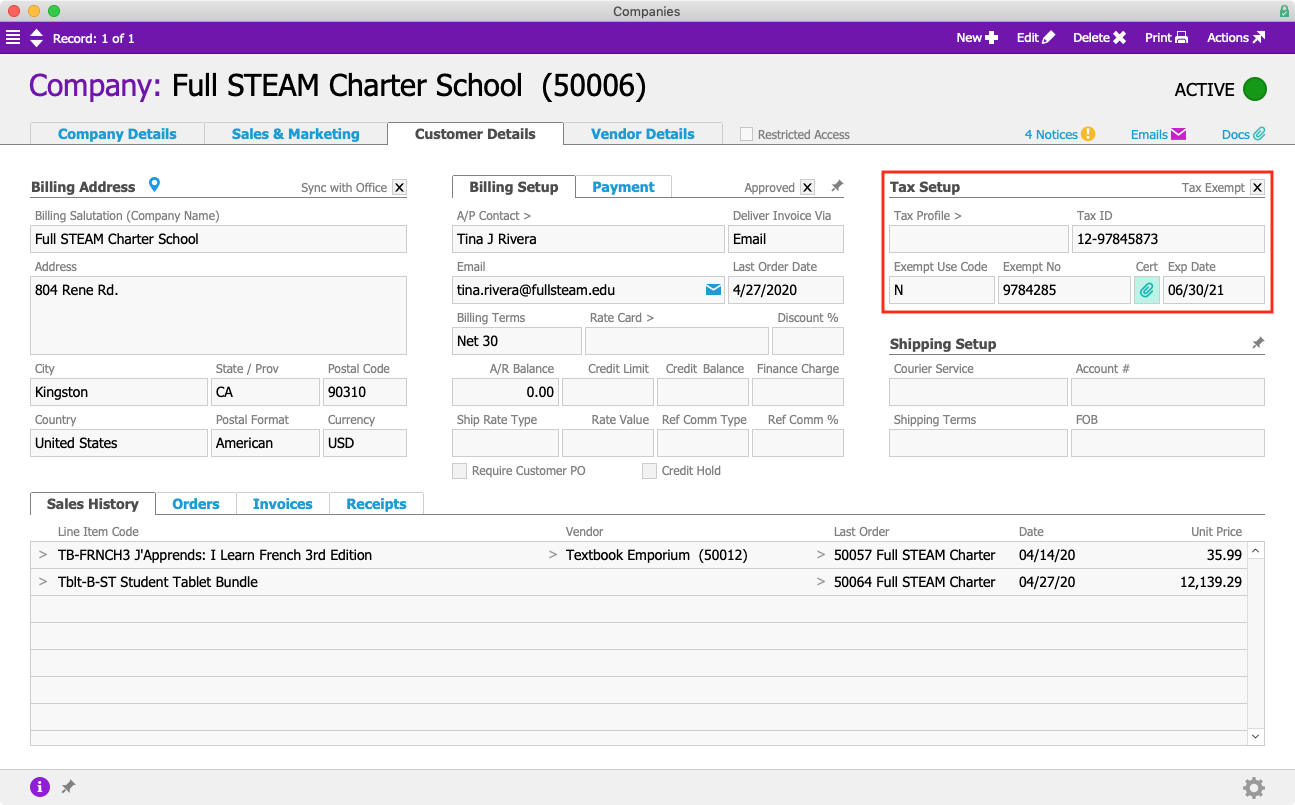

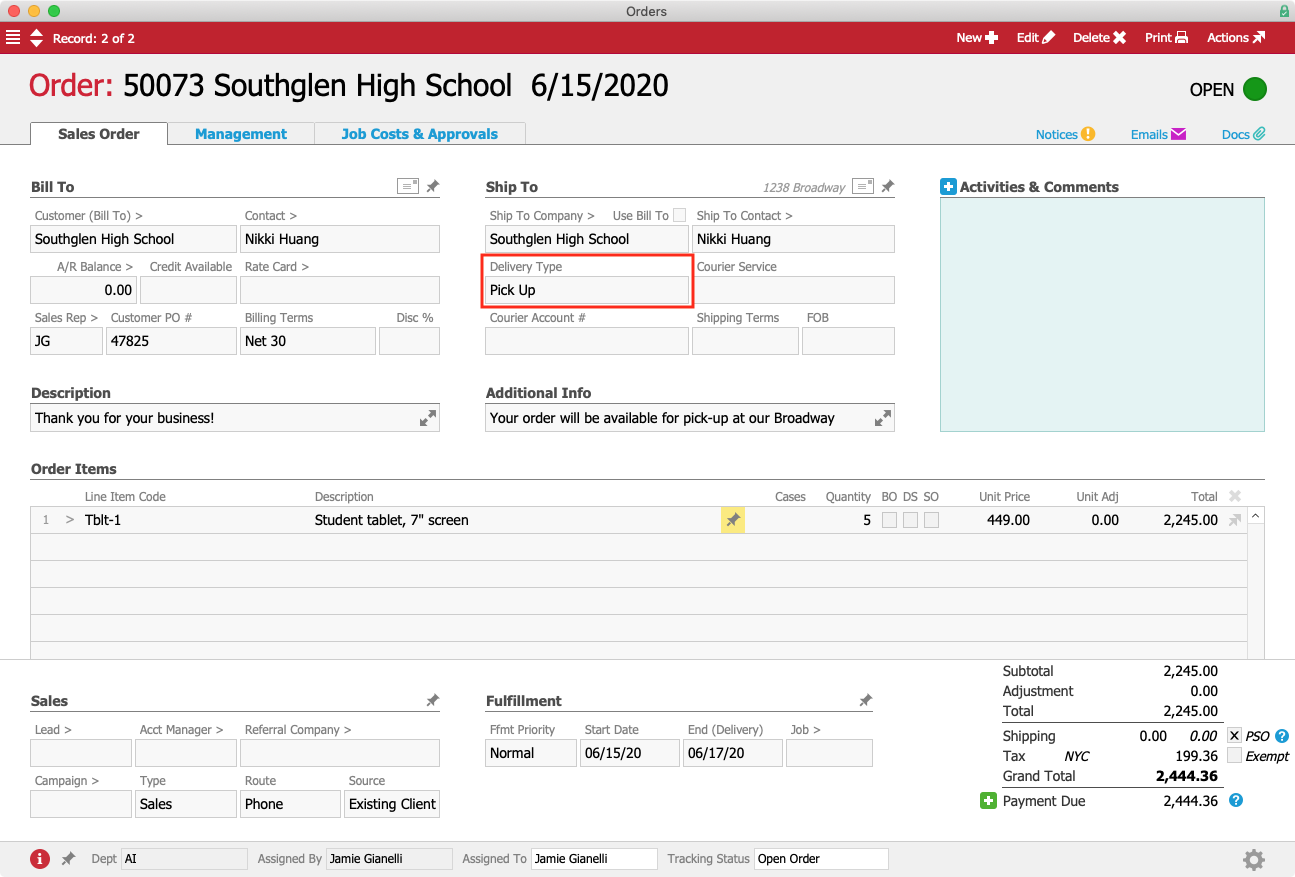

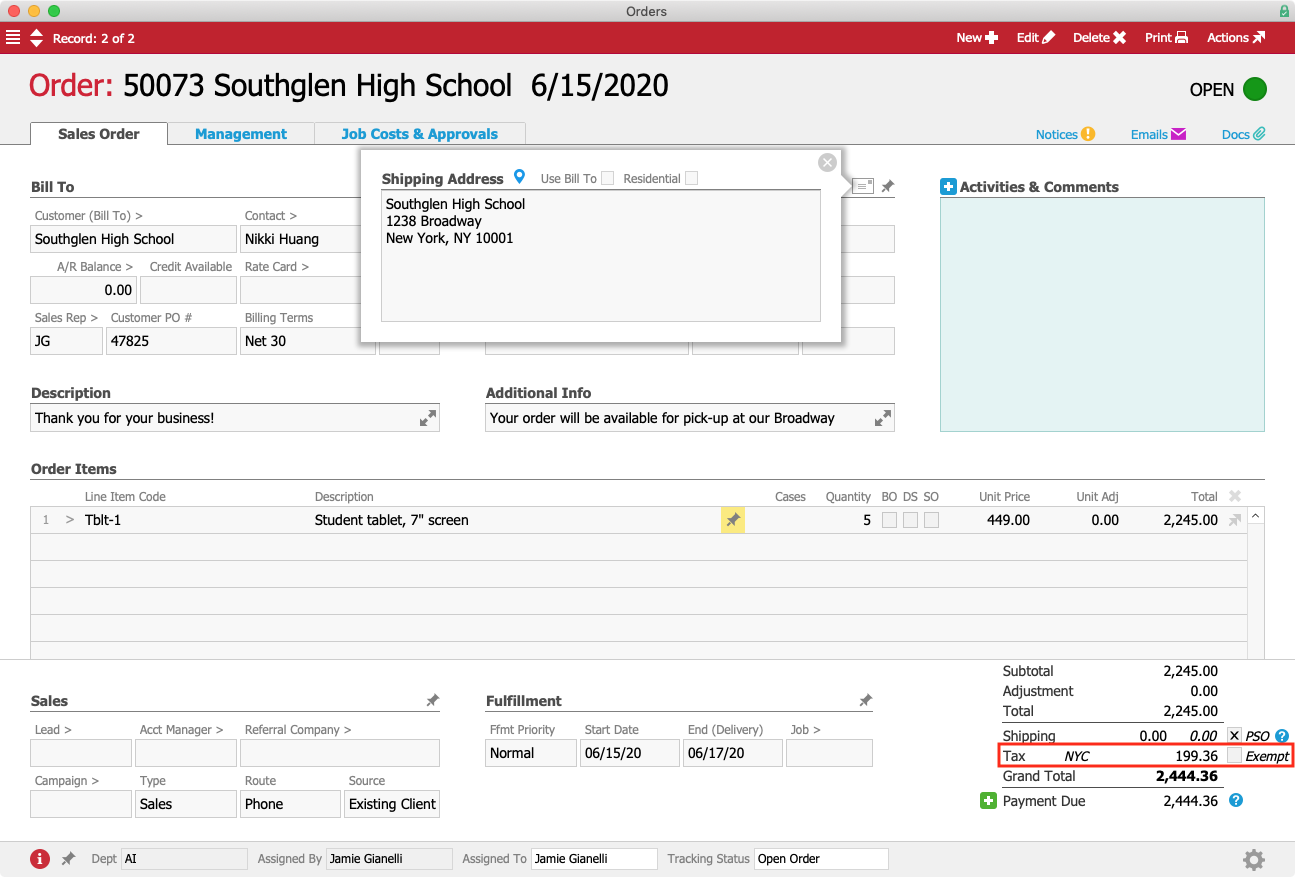

As Duggal has expanded, they’ve also added new locations across the country. From Oregon and California to Manhattan and Long Island, the entire business runs on one single aACE solution located in Brooklyn. This growth hasn’t been without challenges. “Our expansion into California has made tax accountability much more important,” Matthew says. To that end, he’s working with the aACE team on a customized aACE+ Avalara AvaTax integration. “I think that’s a big win.”

Another challenge that comes with the expansion to multiple locations has been ensuring that everyone who needs to can access the many large image files that Duggal deals with every day. Enter aACE’s File Server Folder Launcher feature, which gives users access to the files they need right from within their aACE solution. “Everything goes through aACE,” Rick explains. “We come in, we start up aACE, and we’re in aACE all day.”

Evolving Feature Sets Based on Real-World Workflows

Unlike many other solutions, aACE wasn’t developed by sticking some software engineers in a conference room and asking them to dream up features that might appeal to hypothetical businesses. Instead, aACE has evolved naturally over time by working directly with customers like Duggal to identify, automate, and enhance the workflows they use every day.

The Commissions module is a shining example of this kind of collaboration. As the aACE team built version 5 of the software solution, they made improvements based on requests and feedback from aACE 4 clients like Duggal. The result has been especially valuable as Duggal’s sales team has grown. “It’s been a real game-changer,” says Rick. “There’s been a six-fold or seven-fold increase in terms of how many sales reps we have,” and aACE has easily kept pace with that expansion.

Upgrading from aACE 4 to aACE 5 gave the team “the ability to calculate commissions on the fly, to calculate them at any point in time, to make changes, refresh, redo… There’s a lot more flexibility and accuracy in that report now than there ever was before,” he adds.

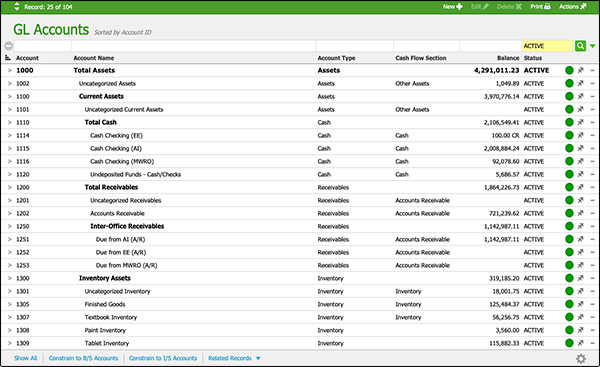

Inventory management was another area of the system that Duggal helped improve. “It was a huge jump forward in giving us a way to audit our inventory process,” Matthew says of the switch from aACE 4 to aACE 5. “We can actually push all that inventory costing and audit it down to the penny, down to each and every transaction. We can track who generated it, whether they put the right costing in at the beginning, and whether it changed later on. The logging is really robust.”

He adds that these tools were developed over time; the aACE team made improvements throughout the life of aACE 4 before pulling out all the stops in aACE 5. “We’ve done a lot of work together,” he says of his relationship with the developers at aACE Software. “The Inventory Counter app using FileMaker Go was something that we sort of built hand-in-hand, but we also don’t lock ourselves into a specific workflow. We use the Inventory Counter app for some inventory, but not all of it. It’s just simpler to count certain things in different ways.”

Cross-Platform Flexibility for Any Workflow

Due to the nature of their work, each project at Duggal is unique — and most go through a series of changes before they’re finalized and sent out to the customer. They needed a software solution that could support multiple workflows, giving their staff the freedom to structure each individual project in a way that makes sense rather than forcing them to conform to a template mandated by their ERP. With some customization, aACE fit the bill so well that even its own architect was astounded at what it could do! “Michael [Bethuy, President of aACE Software] was always fascinated — stunned, actually — at the amount of transactions we have in our system. It’s literally thousands every day,” says Rick. “As our own processes have changed, aACE has changed with us. That’s been very vital.”

And because aACE is built in FileMaker, it was easy for the Duggal team to seamlessly integrate other solutions with aACE, including a custom-built production solution. “The communication back and forth between aACE and that production system has been flawless,” Matthew says. “And that’s a big plus not just for aACE, but for FileMaker. Being on that platform has been key for our success.”

In fact, the FileMaker platform played a role in making aACE more attractive than the other packages they were looking at back when they began their ERP search more than 10 years ago — and that remains true today. “The vast majority of machines at our locations are Macs, but we also have printing equipment and financial people who prefer or are required to be on PCs. Having a solution that everybody could access was an important determining factor in our decision-making process,” Matthew explains. “We looked at NetSuite, we looked at Global Shop, and a couple of smaller FileMaker-based solutions, but nothing impressed us as much as aACE did.”

Results

A Customized Solution on a Trusted Platform

Because Duggal’s order management processes are so one-of-a-kind, it took some trial and error to find a solution that fit. For a time, they even tried developing a custom order-writing solution that would integrate with aACE’s accounting functionality. “We spent about a year and a half preparing that and trying to get it right,” Matthew says. “It lasted about a month and a half.”

As it turned out, the new solution was cumbersome and didn’t quite fit the bill. But, Matthew stresses, there was an upside to the failed experiment: “We learned what we needed through the process of building it from scratch. And we realized that aACE [out-of-the-box] already gave us 85% of that.”

In the end, they incorporated the elements of the new solution that did serve them well back into aACE as custom features. “That was a major turning point,” says Rick, which caused them “to embrace aACE even more and tap into its abilities. We had great people struggling to get through the day [with the custom solution], whereas they were not doing that before when we were on aACE.” Shortly afterwards, Duggal upgraded to aACE 5, which brought even bigger possibilities. “Every one of us was stoked about aACE 5,” Rick says. “That was a very interesting moment for the company. We realized how good we had it.”

A Developer’s Dream

aACE is a comprehensive business management solution powerful enough to support most businesses out of the box – but sometimes unique processes require unique solutions. One of the key benefits to building aACE in FileMaker is that any of the thousands of FileMaker developers world-wide can get under the hood and, with very little training, begin making the product their own. This has proven true for Duggal. “We’ve been able to use FileMaker itself as a platform to hire our own developers, which has allowed us to expand the software as the business expands,” says Rick. “We’ve been growing with it as the central launching point for all sorts of new initiatives in the company.”

The team at aACE Software has welcomed this growth with open arms. “The great thing about aACE and the people that work there is that they’ve always been there for our developers with any questions. They’re great partners, and they’ve never been closed-off. They’ve always welcomed us hiring new developers to work with the system; they want that to be a thing.”

Even Duggal’s in-house developers have been pleasantly surprised by aACE’s elegant design, both in front of and behind the curtain. “One of our programmers, Yelena [Teplitskaya], learned how to become a FileMaker developer while working in aACE,” Rick says, “And today she’s our go-to person for customizing aACE. She works extremely closely with aACE’s developers and she loves it. She thinks the structure of aACE behind the scenes is fantastic; it’s extremely professionally done. She loves the guidelines that have been given and the way that all of the scripting has been done.”

“aACE 5 was built so programmers could customize it,“ Matthew adds. It was built in a way so that programmers, with just a little bit of help, can do some really phenomenal stuff.”

He adds that Yelena has taken the lessons she’s learned from aACE and applied them to other endeavors because aACE has set the bar so high. “The experience behind the way aACE does things has taught her more efficient coding, which is a great thing,” Matthew says. “The more efficient every action is, the more efficient the system is. And Yelena is one of the smartest people we have, so for her to praise aACE really means something.”

“Crazy Awesome” Reporting

The ease with which data can be imported to or extracted from aACE makes reporting a snap. One particular custom report is so robust that Duggal’s CFO dubbed it the Crazy Awesome Report. “It breaks out our entire income statement by department, by time period,” Matthew explains. “It gives the CFO a lot of information, and he regularly gives that report to the CEO, Mike Duggal, as his monthly report. It’s been tremendously helpful for Mike in making steering-the-ship decisions. And creating that report with essentially the touch of a couple buttons vs. how we were doing it, which was hours and hours of Excel work, has made a huge difference.”

Before implementing aACE, Duggal had been using Sage — and a lot of manual work. “When we picked up aACE, our inventory was being ordered using handwritten forms in triplicate,” Matthew explains. “Our accounting software was Sage, but our Controller did everything in Excel. Everything. And our order-writing software was as basic a thing as you can possibly imagine, so almost nothing was being captured. So what aACE has allowed us to do is become the company we are.”

A Decade-Long Relationship Built on Respect

After 10 years, the partnership between aACE and Duggal is still going strong. “We realize more and more every day how rare it is to have a partner that lasts,” Rick says. “Truly the longevity of aACE itself, to be around for 17 years in the software business is pretty amazing. Each company has been growing together, and I think that’s fantastic. There were some growing pains in the beginning, but I think the flexibility, the tolerance, and the understanding on both sides has only grown. We have a great partnership.”

“The flexibility of the system, the eagerness to improve on the part of the team at aACE Software, and the fundamental stability of the solution have all contributed to the longevity of the relationship,” adds Matthew.

Like every long-term relationship, there have been some challenges along the way. “I believe we’ve been a demanding client,” Matthew admits. “And the aACE Software team, over the course of many years, have been able to deliver on some pretty ambitious requests. We’ve been happy with the relationship for the duration.”

“The support has been phenomenal as well,” Rick adds. “Any type of urgent matter gets taken care of extremely fast.”

“Any relationship that lasts this long has to have a good foundation,” says Matthew.

In Their Own Words

Here’s what Matthew Pelfrey, Director of Process and Compliance at Duggal, has to say about their aACE implementation:

“aACE is a digestible midsized company solution that can grow with you. Or shrink with you, if you need to downsize. If that should happen, you’re not on the hook for some crazy-expensive system, and there’s a sense of comfort with that.

“I would be hard-pressed to find a company that aACE wouldn’t fit. The production elements of the system can be as rich and complex as you want them. So companies that are more in the true manufacturing world can operate within the system. It’s a true ERP with inventory management, serialization and lot tracking. It is robust.

“Obviously we don’t have too much of a problem saying good things about the situation we’re in. We’re happy to be partners with aACE, happy to share in our growth and share in their growth, and we can’t wait for aACE 6 and 7. Every update is welcome. The aACE Software team works really hard to give us features that are helpful. They are true solution-finders.”

Do you or someone you know need a change from one-size-fits-all ERP tools? Check out our feature highlights to learn more about whether aACE business management software for Mac and PC can help accelerate your company.

![]() icon, which tells aACE to bypass its internal tax infrastructure and use the Avalara integration instead.

icon, which tells aACE to bypass its internal tax infrastructure and use the Avalara integration instead.